TOP HEADLINES

Gold Steady as Market Holds Breath Before Tight US Election Gold was steady as the market braced for a tight US election, and a Federal Reserve rate decision later in the week. Uncertainty around the presidential vote on Tuesday has aided bullion in the last few weeks. A victory for Donald Trump could push the precious metal up further, given he’s pledging a massive increase in trade tariffs that may fuel inflation. However, the closeness of the race means the final result may not be known for days. Bullion has surged by around a third this year, and is about $50 an ounce below last week’s record high. It’s been supported by easier monetary policy, central-bank buying and heightened geopolitical tensions. The Fed is widely expected to cut rates by a quarter-point on Thursday, with many of its rich world peers also likely to lower borrowing costs. BIS withdraws from Project mBridge after BRICS lauded its potential to aid in dedollarization

Project mBridge was a key talking point at the recent BRICS summit in Kazan, Russia, with the bloc touting its ability to enable the transfer of wholesale central bank digital currencies (CBDCs) among member nations, aiding their de-dollarization efforts. The project, which was launched by the Bank of International Settlements (BIS) in 2021, utilizes technology developed by the Hyperledger Foundation, and in June, it reached the status of minimum viable product, at which point private sector participation was opened. Besides the BIS, the project's founding members include the central monetary authorities of China, Hong Kong, Thailand, and the UAE. Saudi Arabia joined as a full member in June, and the project now has over 25 observing members. But with the tool’s potential to aid Russia in skirting the sanctions placed on the country for its invasion of Ukraine, the Bank for International Settlements (BIS) has now announced that it has “graduated out” of the project it has spearheaded since 2021. During a fireside chat on Thursday at the Santander International Banking Conference 2024 held in Madrid, Spain, Agustin Carstens, General Manager of the BIS, responded to a question regarding media speculation that “Project mBridge could provide the basis for a BRICS initiative to circumvent sanctions,” | Citi says gold could get sold off after the US electionSays Trump win more supportive of equities than goldWall Street Journal convey the info from analysts at Citi:

Citi still like buying dips:

Gold prices may rise further in '25 - UBS CHINA Gold prices may rise to $2,800 per ounce by year-end and could even reach $3,000 next year, according to recent estimates by financial services provider UBS. Factors driving gold price hikes include the rate-cutting cycle started by the US Federal Reserve and major central banks, a weakening US dollar index and ongoing geopolitical risks. "Meanwhile, many central banks continued to buy gold, which has buoyed investor sentiment. Overall market positions remain low, providing significant room for increased holdings, and institutional investors' willingness to buy gold is increasing," said Sharon Ding, head of China Basic Materials at UBS. Gold prices have reached record highs this year. The average London Bullion Market Association (LBMA) pm auction gold price for the third quarter was 28 percent higher year-on-year at a record $2,474 per ounce, according to calculations by the World Gold Council (WGC). Total gold supply increased by 5 percent year-on year to a record 1,313 metric tons in the third quarter, WGC data showed. Ding also noted that the outcome of the US election could impact gold prices, leading to short-term risks of a pullback.  |

GOLD TECHNICAL INDICATOR

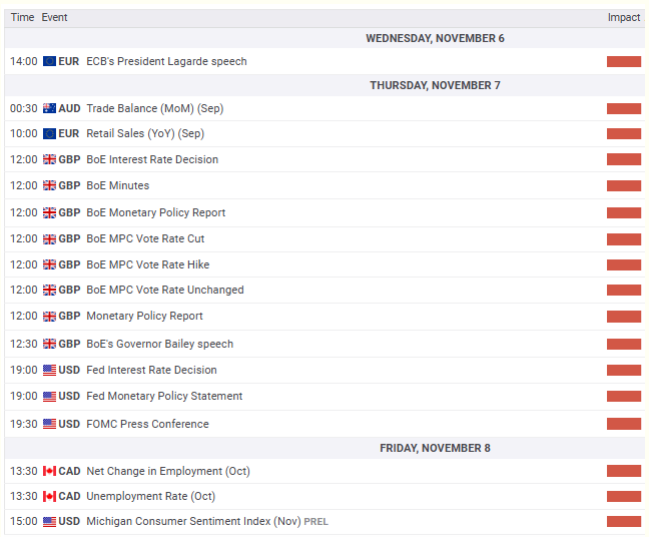

ECONOMIC CALENDAR | |