Latest Newsletter

MAGI MARKET INSIGHT : Edition 26

31 December 2024 | Magi Desk

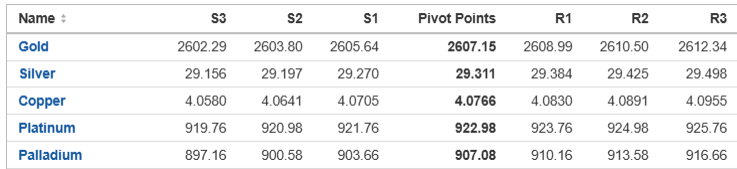

Gold prices dip as markets await fresh catalysts Gold prices dipped in thin trade on Monday as traders awaited fresh catalysts, including next week’s U.S. economic data that could influence the F...

Previous Newsletters

MAGI MARKET INSIGHT Edition: 25

23 December 2024 | Magi Desk

Gold price sharply down on Fed’s surprisingly hawkish pivot Gold and silver prices are strongly lower in early U.S. trading Thursday, following a surprisingly hawkish turn from the U.S. cen...

MAGI MARKET INSIGHT Edition: 24

18 December 2024 | Magi Desk

Gold's surge sees setback ahead of U.S. election and Fed meetingNot only has gold faced solid selling pressure after reaching an intraday high of $2,800 an ounce, but its weekly …

MAGI MARKET INSIGHT Edition: 22

01 December 2024 | Magi Desk

Gold price plunges on keener risk appetite, heavy profit taking Gold and silver prices are strongly lower in morning U.S. trading Monday, on an uptick in investor risk appetite and …

MAGI MARKET INSIGHT Edition: 21

30 November 2024 | Magi Desk

Spot gold steady near $2,625/oz as U.S. Consumer Confidence rises to 111.7 in November Gold prices are holding steady after the latest data showed U.S. consumer sentiment improving as expec...

MAGI MARKET INSIGHT Edition: 20

30 November 2024 | Magi Desk

Gold prices hold support above $2,600 as the Fed sees potential for slower rate cuts The gold market continues to hold solid support above $2,600 an ounce, even as the …

MAGI MARKET INSIGHT Edition: 19

30 November 2024 | Magi Desk

Chinese Banks Raise Risk Levels on Precious Metal Products After Big Gold Price Swings Several Chinese commercial banks have raised the risk classifications on their precious metal products...

MAGI MARKET INSIGHT Edition: 18

27 November 2024 | Magi Desk1

Gold trades in tight range ahead of US inflation data Gold prices flitted within a narrow range on Wednesday as investors awaited key U.S. inflation data for insights into the …

MAGI MARKET INSIGHT Edition: 17

27 November 2024 | Magi Desk1

Gold price ends the week with 5% gain as safe-haven demand drives price action The gold market has ended a three-week selloff with a vengeance, as prices look set to …

MAGI MARKET INSIGHT Edition: 16

27 November 2024 | Magi Desk1

Gold climbs for fourth day with elevated safe-haven demand Gold prices are higher and hit a two-week high in early U.S. trading Thursday. Silver prices are near steady. Some more …

MAGI MARKET INSIGHT Edition: 15

27 November 2024 | Magi Desk1

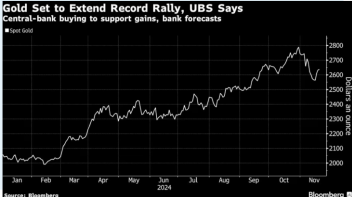

UBS Joins Goldman in Forecasting Gold’s Rally Isn’t Over Gold will rally to $2,900 an ounce by the end of next year, according to UBS Group AG, echoing a call …

MAGI MARKET INSIGHT Edition: 14

27 November 2024 | Magi Desk1

Gold and silver rally on rising US-Russia tensions • Precious metals enjoyed a strong run-up ahead of the US elections but turned sharply lower after a simultaneous surge in the …

MAGI MARKET INSIGHT Edition: 13

27 November 2024 | Magi Desk1

Trump’s America-First policy drives US dollar and bond yields higher, pushing gold prices down 3%, silver prices down 5% After a tight race, former President Donald Trump will become the …

MAGI MARKET INSIGHT Edition: 12

27 November 2024 | Magi Desk1

Trump’s America-First policy drives US dollar and bond yields higher, pushing gold prices down 3%, silver prices down 5% After a tight race, former President Donald Trump will become the …

MAGI MARKET INSIGHT Edition: 8

23 November 2024 | Magi Desk1

Gold Steady as Market Holds Breath Before Tight US Election Gold was steady as the market braced for a tight US election, and a Federal Reserve rate decision later in …