TOP HEADLINES

Gold prices dip as markets await fresh catalysts Gold prices dipped in thin trade on Monday as traders awaited fresh catalysts, including next week’s U.S. economic data that could influence the Federal Reserve’s 2025 interest-rate outlook, as well as policies from incoming President Donald Trump. “I think it’s just the holiday thin trade. Perhaps some squaring of the books before yearend,” said Peter Grant, vice president and senior metals strategist at Zaner Metals. Geopolitical tensions are expected to remain high into next year, with central banks continuing to buy gold, while the U.S. debt situation is likely to worsen and the deficit to grow under the Trump administration, fuelling ongoing safe-haven demand for the metal, Grant said. Gold has surged nearly 27% this year, reaching a record high of $2,790.15 on Oct. 31, as investors sought the yellow metal amid geopolitical uncertainty and U.S. rate cuts. Anticipation of major U.S. policy shifts in 2025, including potential tariffs, deregulation and tax changes, has grown as Trump prepares to take office in January. Earlier this month, Fed Chair Jerome Powell signalled a cautious stance on further rate cuts after delivering a quarter-point reduction, aligning with market expectations. A slew of U.S. economic data due next week includes job openings figures, the ADP employment report, the Fed’s December FOMC minutes, and the U.S. employment report, to gauge the health of the economy. Potential Scenarios and Trading Ranges for Gold in 2025Gold’s price could vary according to how the Trump administration’s policies evolve. We see three potential outcomes: • Base Case (50% Probability): Gold has a potential trading range between US$2,600/oz and US$2,900/oz. Under this scenario US growth continues to surprise to the upside, causing inflation metrics to remain higher than expected, and the fed funds rate to stay higher than the projected 3.25% to 3.50% from September 2024. In this case, gold-backed ETF flows fluctuate throughout the year. Meanwhile, consumer demand for gold in Asia remains steady, while robust central bank gold buying creates a “soft floor” on the precious metal’s price. • Bull Case (30% Probability): Gold trades between US$2,900/oz and US$3,100/oz. This occurs if US growth slows down enough to create weakness in the labor market, enabling the Fed to cut rates to 3.25% to 3.5% by the end of 2025. Gold-backed ETF inflows are mostly positive all year and consumer demand for gold in Asia strengthens as lower rates weaken the US dollar. Central banks continue to buy gold. • Bear Case (20% Probability): Gold trades between US$2,200/oz and US$2,600/oz if US growth accelerates far more than expected, as the new administration’s business-friendly initiatives strengthen the manufacturing sector. Sturdy growth puts pressure on inflation, causing the Fed to pause on rate cuts, and higher interest rates strengthen the US dollar as foreign flows into US assets increase. Meanwhile, Asia demand weakens in the short-term due to prolonged US dollar strength. Gold-backed ETFs experience outflows, but gold’s price finds a floor from continued robust central bank buying.

Gold prices struggling as U.S. pending home sales rise 2.2% in November

The gold market is struggling to hold support at $2,600 an ounce and could face increased selling pressure as the U.S. housing market shows further signs of stabilizing as more consumers start the process of buying a new home, according to the latest data from the National Association of Realtors (NAR). The U.S. pending home sales index rose 2.2% in November, the NAR announced on Monday, after October’s 1.8% increase. The data was significantly better than forecasts, as economists expected a 0.9% increase. According to the report, contract signings grew in all four U.S. regions in the last 12 months, with the West showing the biggest jump. For the year, pending home sales are up 6.9%. The gold market is not seeing a significant reaction to the latest economic data; however, according to some analysts, it could add to the selling pressure as the market struggles on its back foot near a critical support level.

| Chinese Gold Premiums Rebound: Key Insights on Recent Gold Trends

2024 has been a tale of two-halves for the Chinese market which is unsurprising given that the gold price has rallied 30% during the calendar year. This has had a significant impact on Chinese premiums as the beginning of the year saw Chinese prices trading higher than world prices, yet the midpoint of the year saw a reversal of this, leading the Chinese gold price to trade at a discount. Data from early December 2024 shows signs of the premium coming back into the Chinese market with gold prices in China surpassing global benchmarks by $4.4/oz on December 20 2024, following months of discounts as deep as $40.6/oz in October. This shift marks the first significant premium since mid-August 2024 and signals strengthening domestic demand as the recent gold price stabilization has given buyers more confidence to enter the market again. The return of Chinese gold premiums is a bullish signal for the global gold market. Rising Chinese premiums could indicate a recovery in demand, supporting higher global gold prices in the near term. Chinese investors are thought of as shrewd buyers and so if they are seeing the recent dip in gold prices as a buying opportunity, this may become a wider trend in the global economy which provides fundamental justification for our long-term bullish view on the precious metal. Gold 2025 Outlook: More Room to Run – STATE STREET

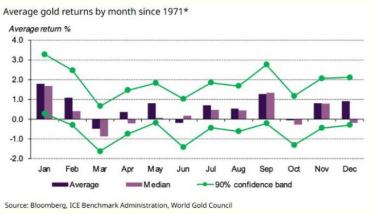

Despite a resilient US dollar and gold’s spectacular 2024 run, we think its price could go as high as $3,100/oz in 2025. Central bank buying remains strong; consumer demand from India and China is growing; and we see more investors seeking gold due to expected rate cuts (with financial positioning not stretched, historically or normalized), geopolitical tensions, and worsening fiscal deficits. Although gold’s momentum stalled in November as Donald Trump’s win at the polls drove a surge in risk assets and the US dollar, we think its price still has room to run in 2025. The base case is for gold to range between $2,600 and $2,900 in 2025, with the potential to rise to $3,100 under certain economic scenarios. There are three good reasons to be bullish on gold:• Strong central bank purchases of gold are expected to continue unabated, helping tooffset any negative impact a strong dollar might have on price. • Consumer demand in China and India is growing as local gold mutual funds and ETFs proliferate and regulations encourage gold ownership. • Monetary easing and the potential for the new Trump administration’s fiscal policies to raise deficits and stoke inflation should lower the opportunity cost of buying gold versus the US dollar or Treasurys. Equity markets have had another stellar year, and the risk-on tone has been strengthened by PresidentElect Trump’s pro-growth and business-friendly policies. But there’s also no shortage of anxiety about the tail risks of inflation, rising government debt, and worsening geopolitical tensions. In fact, high net worth investors surveyed in our 2024 Gold ETF Impact Study have nearly doubled their allocations to gold in the past year and cited its safe-haven status as the reason. Gold count on its best month of the year to start 2025 trading.It's a bit of a tricky one this time around with gold prices rising by over 27% already in 2024. Things have cooled off in November and December so far but that arguably owes much to the US election result, which in turn has also impacted the Fed outlook somewhat for next year. A surging dollar has helped to keep things in check, for now at least. The recent seasonal pattern also suggests that January is the best month for gold over the past decade. However, that hasn't quite been the case in the post-pandemic era. One can argue that in part, there is some frontrunning in the buying in December. But is it perhaps to do with China also struggling during this period. After all, there is always the thought of that gold rush coming through ahead of the Lunar New Year celebrations. That being said, China itself has been a big fan of gold in the last 12 months. That in spite of what the central buying data might suggest. Looking to next month, there are a couple of things that could set gold back to start the new year. The big one of course is market players still having the fresh memory of a more hawkish Fed from last week. That has put the dollar in a decent spot and we could see broader markets pick up from that momentum at the turn of the year.

|

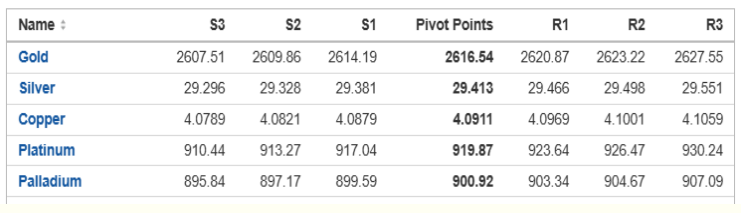

TECHNICAL INDICATOR

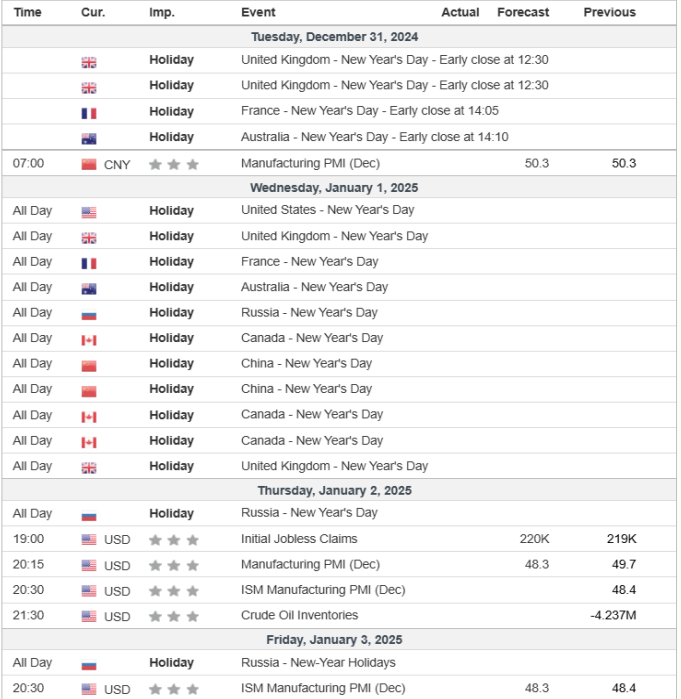

ECONOMIC CALENDAR

| |