TOP HEADLINES

Gold price sharply down on Fed’s surprisingly hawkish pivot

Gold and silver prices are strongly lower in early U.S. trading Thursday, following a surprisingly hawkish turn from the U.S. central bank Wednesday afternoon. Gold prices hit a four-week low and silver prices a three-month low. U.S. stock index futures have rebounded and U.S. Treasuries have steadied overnight after the Federal Reserve’s surprisingly hawkish pivot on U.S. monetary policy Wednesday afternoon. While the Fed announced a 25 basispoint interest rate cut, as expected, the FOMC’s quarterly summary of economic projections (dot plots) showed the majority of FOMC members now expect just 50 basis points in rate cuts in 2025. That’s a major change in the FOMC’s thinking since the last dot plot meeting in September, when the FOMC forecast was for 100 basis points in rate cuts in 2025. The hawkish pivot sunk precious metals, saw a big surge in the U.S. dollar index and in Treasury bond yields. Fed Chairman Jerome Powell said in his postFOMC press conference this is a “new phase” where inflation concerns are back on the table. While the new policy setting is still “meaningfully restrictive,” that’s what it needs to be, because inflation remains above the 2% target, he said. “We still have work to do” to bring down inflation, said Powell. Bitcoin Drops to $100K as El Salvador Modifies BTC Policy in IMF DealEl Salvador has agreed to make merchant acceptance of Bitcoin voluntary as part of a $1.4 billion loan agreement with the International Monetary Fund (IMF). Meanwhile, Bitcoin made a bearish move yesterday (Wednesday), causing its price to drop to $100000. The cryptocurrency had reached an all-time high of $108,000 the day before. The country will also scale back its involvement with the Chivo wallet, which has seen limited use, and restrict public sector participation in Bitcoin-related activities. These changes are aimed at reducing El Salvador's debt-to-GDP ratio, according to an IMF statement on December 18. IMF Agreement Limits Bitcoin UseThe agreement, set to last 40 months, requires El Salvador to implement legal reforms, making Bitcoin acceptance voluntary for the private sector. Additionally, public sector engagement with Bitcoin will be confined, with taxes to be paid in US dollars, the country’s official currency. The IMF noted that government involvement in Chivo will be gradually phased out. “The potential risks of the Bitcoin project will be diminished significantly in line with Fund policies. Legal reforms will make acceptance of Bitcoin by the private sector voluntary,” the IMF said. India’s Record Gold Import Likely Due to Calculation ErrorA surge in gold imports that widened India’s trade deficit to a record last month and pushed the rupee to an all-time low was due to an error in calculation, according to people with knowledge of the matter. Officials doublecounted gold shipments in warehouses following a change in methodology in July, the people said, asking not to be identified ahead of an expected formal clarification. Attempts are on to reconcile the data, which could have been over-estimated by as much as 50 tons in November or almost 30% of total imports of the precious metal that month, some of the people said. If an error is indeed identified, the trade figures are likely to be revised and traders could expect some correction in the foreignexchange rate. It would also soothe feverish speculation about the state of the economy triggered by the data, as economists pondered over whether the surge in gold purchases signaled distress and a need to hedge against inflation or a move that indicated prosperity in the hinterland caused by a healthy crop. India’s trade deficit ballooned to an unprecedented $37.8 billion in November, driven by a four-fold increase in gold imports to a record $14.8 billion, from just $3.44 billion a year ago. While gold imports have risen steadily since the government cut duties on the precious metal to 6% from 15% in the July budget, the sharp spike had stumped analysts. | Gold up against British pound as BoE leaves interest rates unchanged

Gold prices are pushing higher against the British pound as the Bank of England (BoE) left interest rates unchanged, but remains in a difficult position as inflation rises while economic activity weakens. As expected, the British central bank left the Bank Rate at 4.75%. However, the 6-to-3 vote in favor of holding rates steady was slightly more dovish than anticipated. Economists had forecasted a 7-to-2 vote. The BoE noted in its decision that inflation last month came in hotter than expected, rising 2.6%, up sharply from the 1.7% reported in September. The central bank also sees inflation risks increasing. “Headline CPI inflation is expected to continue to rise slightly in the near term. Although household inflation expectations have largely normalized, some indicators have increased recently,” the central bank said in its monetary policy statement. However, the BoE is stuck between a rock and a hard place as it also observes slowing economic growth. “Most indicators of UK near-term activity have declined. Bank staff expect GDP growth to have been weaker at the end of the year than projected in the November Monetary Policy Report,” the BoE said. “There remains significant uncertainty around developments in the labor market.” Japan's Central Bank Holds Rates as Uncertainties Complicate OutlookThe Bank of Japan held its policy interest rate steady on Thursday as it waits for uncertainties abroad to clear further and for more evidence of economic recovery at home. The Japanese central bank maintained its target for the overnight call rate at 0.25%, the level it has been at since the last hike in July when the yen's weakness triggered fears over higher import prices. Unlike other global central banks, including the Federal Reserve, which cut interest rates by 25 basis points on Wednesday, economists expect the Bank of Japan to raise interest rates again soon. Policymakers generally agree that the economy is on track to reaching its goal of stable inflation backed by wage growth. They are waiting to see how political developments at home and abroad turn out, including economic policies under President-elect Donald Trump and tax reform discussions in Japan. As the bank has pledged to keep raising rates, BOJ Gov. Kazuo Ueda may indicate a possibility of a January rate hike at his news conference later Thursday. BlackRock says diversify your portfolio with gold and bitcoinBlackRock Investment Institute (BII) has identified gold and Bitcoin as potential diversifiers to hedge against equity sell-offs, noting that traditional diversification options like bonds have become less effective. In an extensive “2025 Global Outlook,” BII highlighted the distinct value drivers of Bitcoin, including its fixed supply and its potential for broader adoption as a payment system. “Bitcoin’s role as a store of value and payments system make it a potential diversifier,” said Samara Cohen, Chief Investment Officer (CIO) of ETFs and Index Investments at BlackRock. The asset’s limited historical correlation with equities further supports its diversification potential. “Bitcoin’s correlation to global equities remains limited, even with the occasional spike. Given its unique value drivers, we see no intrinsic reason why bitcoin should be correlated with major risk assets over the long term,” BlackRock’s report states. CBUAE's gold reserves surpass $6.26bln by end of Q3/24The gold reserves of the Central Bank of the United Arab Emirates (CBUAE) exceeded AED23 billion by the end of Q3/24. This represents a month-on-month increase of 5.3%, or AED1.164 billion, bringing the total gold reserves to AED23.185 billion compared to AED22.021 billion at the end of August. Since the beginning of the year, the gold reserves have grown by more than 27.76%, or over AED5 billion, from AED18.147 billion at the end of last year, According to the CBUAE's Monthly Statistical Bulletin for September released today. In the meantime, the bulletin indicated that the value of demand deposits grew by more than 3% to exceed AED1.083 trillion at the end of September, of which AED781.528 billion were in the local currency. It added that the banking sector has witnessed a significant surge in deposits, with savings deposits reaching AED304.534 billion, of which approximately AED256.6 billion is denominated in the local currency. Furthermore, time deposits have reached AED888.473 billion, with around AED542.6 billion in local currency. |

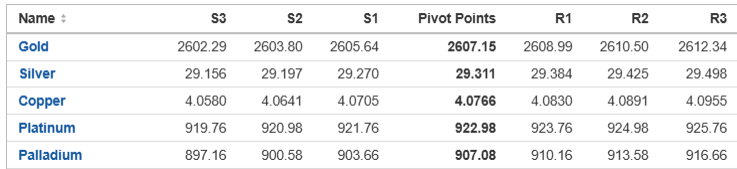

TECHNICAL INDICATOR - PIVOT TABLE

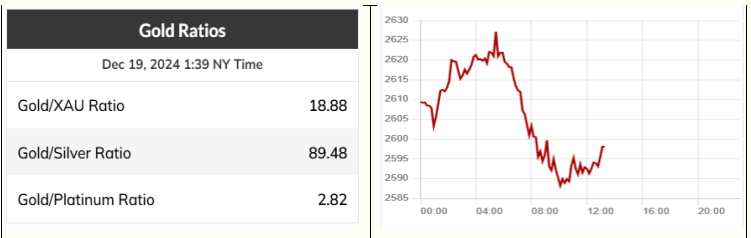

GOLD RATIOS AND PRICE MOVEMENTS

ECONOMIC CALENDAR

| |