TOP HEADLINES

Gold price plunges on keener risk appetite, heavy profit taking

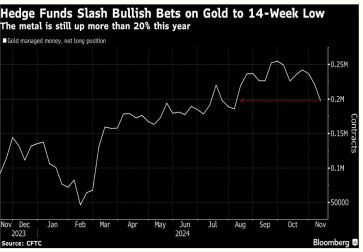

Gold and silver prices are strongly lower in morning U.S. trading Monday, on an uptick in investor risk appetite and heavy profit-taking pressure from the shorter-term futures traders. December gold was last down $70.00 at $2,642.20 and December silver was down $0.948 at $30.39. The U.S. general marsystem is in “safe hands” with Bessent the head of the U.S. Treasury. Bessent will have a tough new job, as a Wall Street Journal story today is headlined: “Markets shine spotlight on deficits.” That’s one reason U.S. Treasury yields have risen the past several weeks. Asian and European stock markets were mixed overnight. U.S. stock indexes are pointed toward higher openings when the New York day session begins—also a negative for the safehaven metals. Gold could jump 11% next year as central banks ramp up their buying spree, Goldman Sachs economist saysThe price of gold could hit $3,000 an ounce next year as central bankers continue to scoop up the precious metal, Samantha Dart, the co-head of commodities research at Goldman Sachs, said. The price of gold traded around $2,698 an ounce early Friday, with Dart's forecast implying 11% upside. That increase will be fueled primarily by central bank buying, she said, with central banks around the world already having scaled their purchases of gold five-fold compared to their pre2022 average. Last quarter, central bank purchases of gold more than doubled on a year-over-year basis to 186 tons, according to data from the World Gold Council. Central bankers have snapped up 694 tons of gold since the start of the year, on par with last year's levels, the group said in an October report. Gold prices could also be supported through ETF buying, she said, noting that many traders were interested in safe-haven assets amid higher economic and geopolitical uncertainty. The world's total gold demand hit 1,313 tons in the third quarter, representing a record value of over $100 billion, World Gold Council data shows. Gold investment demand, meanwhile, more than doubled on a year-over-year basis last quarter, reaching 364 tons. Bitcoin drops below $93k as cryptos correct, but analysts see bull market intact

Cryptocurrency prices experienced a sell-off overnight as the correction analysts had been warning about deepened, though interestingly, the drawdown is seen as a positive sign for the health of the bull market and sets things up for the rally to extend well into 2025. The cryptocurrency market is under pressure, losing about 4.6% in 24 hours to $3.2 trillion by the start of active trading in Europe,” noted Alex Kuptsikevich, chief market analyst at FxPro. “These are five-day lows, with the crypto market driven by a sell-off in safe havens such as Bitcoin (BTC) and gold in hopes of deescalating tensions between Lebanon and Israel.” “The Cryptocurrency Fear and Greed Index fell to 79,” he added. “That is still extreme greed, but the index's lowest level in two weeks.”  | Gold tumbles 3% on reports of IsraelHezbollah ceasefire, U.S. Treasury pick Gold prices plunged about 3% on Monday, breaking a five-session rally to its highest in nearly three weeks, as reports of Israel nearing a ceasefire with Hezbollah, coupled with Trump’s nomination of Scott Bessent as the U.S. Treasury Secretary soured the precious metal’s safe-haven appeal. Gold prices were primed for a sell-off on buying exhaustion after last week’s rally. Scott Bessent’s Treasury Secretary appointment further took away some of the risk premium associated with the U.S., said Daniel Ghali, commodity strategist at TD Securities. “And even more so, reports that Israel and Lebanon have agreed to terms of an agreement to end the Israel and Hezbollah conflict have pushed gold prices even further (lower).” Gold is traditionally seen as a safe investment during economic and geopolitical uncertainty such as conventional or trade wars.  Some market participants see Bessent as less negative for a trade war, said UBS analyst Giovanni Staunovo. Bullion hit its highest since Nov. 6 in early Asian trade following last week’s nearly 6% weekly surge, its best since March 2023, spurred by escalating tensions in the RussiaUkraine conflict. Traders are also gearing up for a pivotal week, with minutes from the Federal Reserve’s November meeting, U.S. GDP revisions, and core PCE data expected to provide insights into the central bank’s policy outlook. “I still anticipate a 25 bps rate cut in December, but recent Fed speakers have taken on a more cautious tone heading into 2025, which could pose a bit of a headwind for gold,” said Peter Grant, vice president and senior metals strategist at Zaner Metals. China's central bank keeps medium-term loan rate unchanged amid yuan weakness.China on Monday kept its medium-term lending rate steady, as the country's central bank seeks to stabilize the yuan which has come under pressure following Donald Trump's victory in the U.S. presidential election. The People's Bank of China kept the medium-term lending facility rate unchanged at 2.0% on 900 billion yuan ($124.26 billion) worth of one-year loans to some financial institutions, according to the bank's official statement. "It is a well-expected move, given that the market liquidity [has] remained ample," said Bruce Pang, chief economist and head of Research, Greater China at JLL, citing PBOC's move in October that injected 500 billion yuan into the banking system. Keeping the MLF rate intact allows for "greater policy maneuverability" given the change in U.S. administration, at a time when commercial banks' net-interest-margins have remained tight, Pang added.  |

TECHNICAL INDICATOR : USD – INR PIVOT TABLE

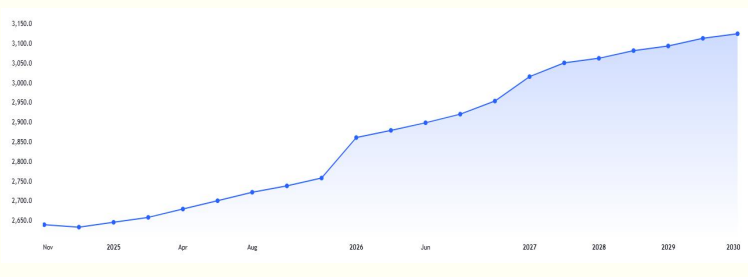

Gold Futures forward curve chart

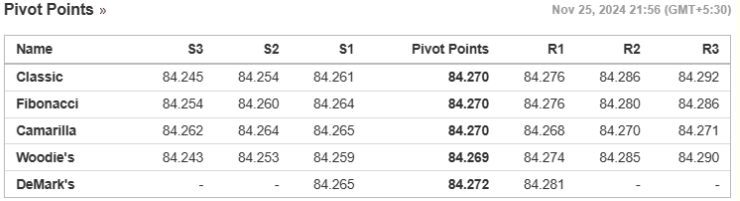

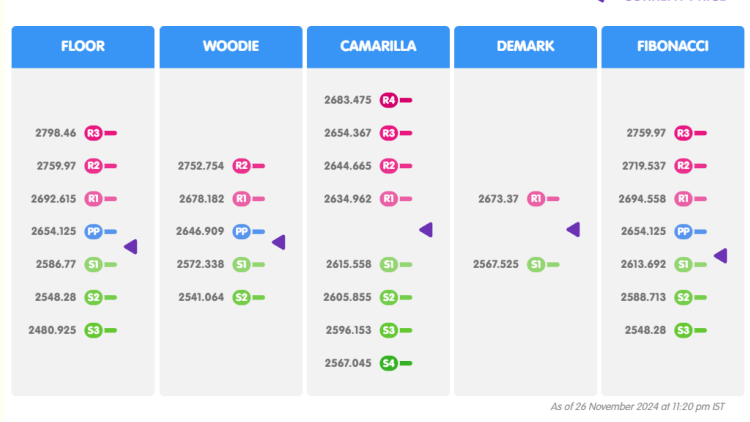

GOLD PIVOT TABLE

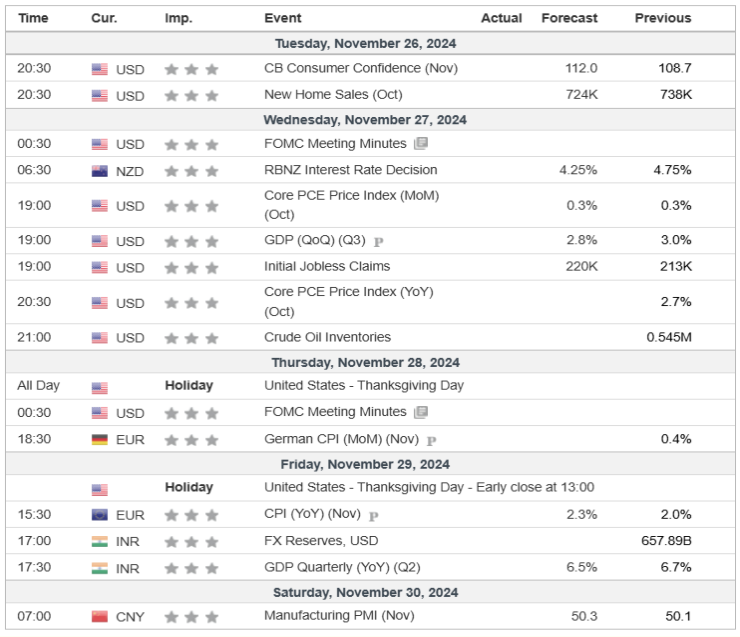

ECONOMIC CALENDAR | |