TOP HEADLINES

Spot gold steady near $2,625/oz as U.S. Consumer Confidence rises to 111.7 in November

Gold prices are holding steady after the latest data showed U.S. consumer sentiment improving as expected this month. The Consumer Confidence Index rose to 111.7 in November, in line with economists’ consensus forecast for a 111.6 reading and above the upwardly revised 109.6 print in October, the Conference Board said on Tuesday. The Present Situation Index, based on consumers’ assessment of current business and labor market conditions, increased by 4.8 points to 140.9, while the Expectations Index, based on consumers’ short-term outlook for income, business, and labor market conditions, edged up 0.4 points to 92.3, well above the threshold of 80 that usually signals a recession ahead. “Consumer confidence continued to improve in November and reached the top of the range that has prevailed over the past two years,” said Dana Peterson, Chief Economist at The Conference Board. “November’s increase was mainly driven by more positive consumer assessments of the present situation, particularly regarding the labor market. Compared to October, consumers were also substantially more optimistic about future job availability, which reached its highest level in almost three years. Meanwhile, consumers’ expectations about future business conditions were unchanged and they were slightly less positive about future income.” Bitcoin drops below $93k as cryptos correct, but analysts see bull market intact

Cryptocurrency prices experienced a sell-off overnight as the correction analysts had been warning about deepened, though interestingly, the drawdown is seen as a positive sign for the health of the bull market and sets things up for the rally to extend well into 2025. The cryptocurrency market is under pressure, losing about 4.6% in 24 hours to $3.2 trillion by the start of active trading in Europe,” noted Alex Kuptsikevich, chief market analyst at FxPro. “These are five-day lows, with the crypto market driven by a sell-off in safe havens such as Bitcoin (BTC) and gold in hopes of deescalating tensions between Lebanon and Israel.” “The Cryptocurrency Fear and Greed Index fell to 79,” he added. “That is still extreme greed, but the index's lowest level in two weeks.” Gold prices in NEPAL drop by Rs15,900 per tola after cut in customs duty

The price of gold dropped by Rs15,900 per tola (11.664 grams) on Monday following the government’s decision to decrease the customs duty on the precious yellow metal. According to the Federation of Nepal Gold and Silver Dealers Association, the price of hallmark gold has been set at Rs151,300 per tola for today, down from Rs167,200 on Sunday. The government has slashed the customs duty on gold imports by 50 percent, from 20 percent to 10 percent. This decision was made during a Cabinet meeting on Thursday. Through its budget, India reduced the customs duty on gold and silver from 15 percent to 6 percent. In contrast, Nepal had increased the gold customs duty by 5 percent, raising it to 20 percent in the current fiscal year’s budget. This made gold more expensive in Nepal and cheaper in India, leading to smuggling. The Federation said the imbalance in customs duties due to the open border encouraged illegal trade. To prevent such trade, the Federation suggested that the customs duty be set at 8 percent. Indonesia - Antam plans to acquire domestic, international gold minesState-owned mining company PT Aneka Tambang (Antam), a company incorporated in the holding company PT Mineral Industri Indonesia (MIND ID), has planned to explore and acquire gold mines, both domestically and abroad. Currently, Antam has studied various prospects related to the acquisition of domestic gold mines. However, the company has not been able to divulge which mining areas will be acquired. “We cannot say the area yet, it is in Indonesia. When it is called a corporate action, we cannot say everything,” Abdul Bari, General Manager of Antam, said . Previously, Antam has signed an agrement to purchase 30 tons of gold from PT Freeport Indonesia (PTFI) factory in Gresik, East Java, worth US$12.5 billion (Rp195.7 trillion). This was done to encourage the downstreaming and industrialization of natural resource-based mining, which are part of the 17 priority programs of the goverment  | Gold prices push to neutral territory as U.S. new home sales fall 17.3% in October The gold market continues to hold solid support above $2,600 an ounce as the U.S. housing sector struggles, even with the Federal Reserve embarking on a new easing cycle. New home sales dropped 17.3% last month to a seasonally adjusted annual rate of 610,000 homes, below September’s revised rate of 738,000, the U.S. Census Bureau and the U.S. Department of Housing and Urban Development announced Thursday. The latest sales data significantly missed expectations, as consensus forecasts anticipated a rate of around 725,000 homes. Annual sales, which strip out monthly volatility, continue to highlight significant weakness in the housing market, with sales down 9.4% from October 2023. In response to the disappointing housing data, the U.S. gold market has retraced most of its overnight losses, with prices trading in roughly neutral territory. Spot gold last traded at $2,622.20 an ounce, down 0.08% on the day. Some economists have noted that although the Federal Reserve has started to cut interest rates, mortgage rates remain elevated. Mortgage rates have stayed above 6% for the past two years, as 10-year bond yields remain high. Smuggled gold entering Turkey nears 50 tons in one year, industry says

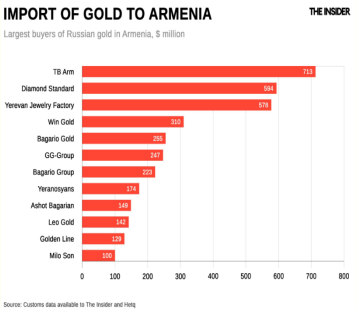

The gold industry has raised concerns over the rising amounts of gold smuggled into Turkey, following a significant decline in formally imported gold compared to long-term averages. As of the end of September 2024, the amount of gold imported into Turkey stood at 88 tons, significantly lower than the 30-year average of 132 tons for the same period, leaving a gap of 44 tons, according to Mustafa Atayık, the Chair of the Istanbul Jewelers Association. “Since our sector continues to work and produce despite all the troubles, where does the difference of 44 tons come from? We leave the answer to you,” Atayık told the online news outlet Ekonomim. Since the implementation of import quotas on gold last year, there have been claimincrease in smuggling, with a price difference exceeding $5,000 per kilogram compared to international markets. Industry representatives argue that this price gap has accelerated the flow of smuggled gold into the country. According to data from the Trade Ministry, in the January-October period this year, 2.5 billion Turkish liras ($72.2M) worth of smuggled gold was intercepted at the borders while attempting to enter Turkey. Chinese firms bet on African gold as prices surge in the face of uncertainty As gold prices surge, Chinese investors are betting on Africa to secure gold supplies by stepping up mining activities in South Africa and Ghana, the continent’s two top exporters of the precious metal. China-African Precious Metals Company (CAPM), a subsidiary of Shanghai Stock Exchange-listed Pengxin International Mining, has opened a newly refurbished gold processing plant in Orkney, South Africa. The mine is located in South Africa’s Witwatersrand basin, home to one of the world’s largest known gold reserves. The Chinese firm invested 200 million rand (US$11 million) in the resuscitation of the gold processing plant, a move that is expected to create nearly 4,000 jobs in South Africa. The plant is part of a 2 billion rand investment in the company’s Orkney mine operations in the country’s North West province. How Russia circumvents sanctions to export billions of dollars worth of gold through ArmeniaGold was one of the first Russian exports that this has led to an 2022. In June 2022, the U.S. banned the purchase of the precious metal from Russia, calling it the “country’s biggest non-energy export.” Officially, this embargo only applies to imports into the United States. However, if a third country purchases gold linked to Russia, it becomes ineligible for sale in the U.S., effectively barring banks from using it for investment or trading. This means that, unlike restrictions on most other imports, the American embargo on “bank gold” effectively has global implications. After the start of the full-scale war, the flow of Russian gold shifted eastwards — from the U.K to the UAE, Hong Kong, and Turkey. However, by April 2023, even these flows had ceased completely. Since then, no Russian gold has been exported outside the Eurasian Economic Union (EAEU). Around the same time, Armenia emerged as a major gold exporter, according to reports. |

TECHNICAL INDICATOR :

US DOLLAR INDEX

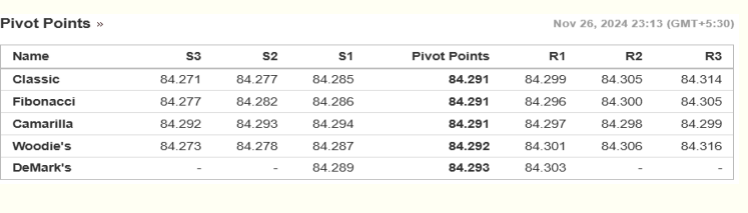

USD – INR PIVOT TABLE

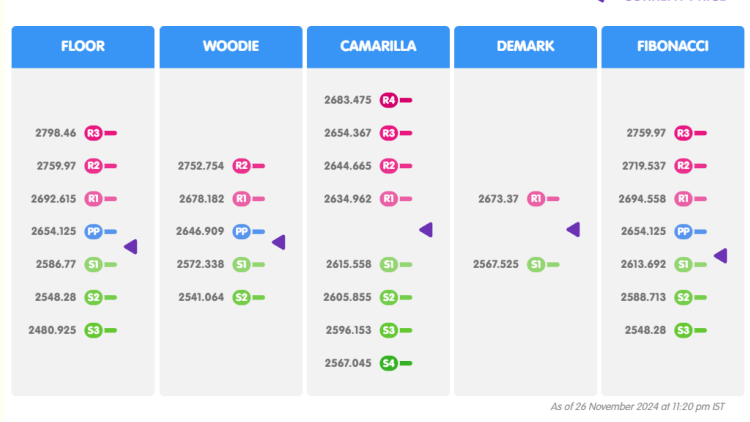

GOLD PIVOT TABLE

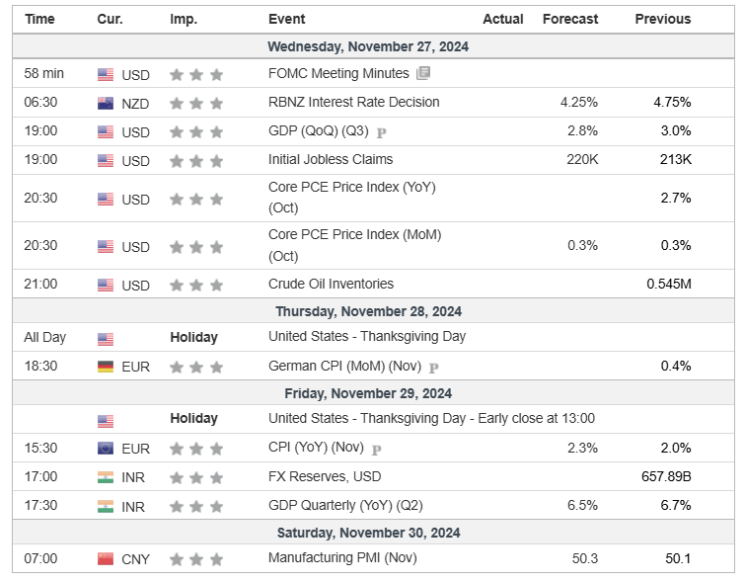

ECONOMIC CALENDAR | |