TOP HEADLINES

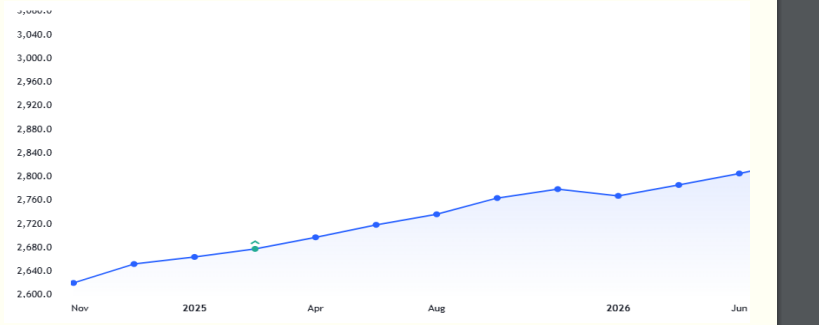

Gold prices hold support above $2,600 as the Fed sees potential for slower rate cuts

The gold market continues to hold solid support above $2,600 an ounce, even as the Federal Reserve signals a potential slower pace of easing, according to the minutes from the Federal Reserve’s November monetary policy meeting. The minutes reveal that the monetary policy committee continues to expect inflation to trend toward the 2% target. At the same time, the central bank noted that downside risks to the economy and the labor market have slightly eased, reducing the need for aggressive action. “Almost all participants agreed that risks to achieving the Committee’s employment and inflation goals remained roughly in balance. Some participants judged that downside risks to economic activity or the labor market had diminished. Participants noted that monetary policy would need to balance the risks of easing policy too quickly—thereby possibly hindering further progress on inflation—with the risks of easing policy too slowly, thereby unduly weakening economic activity and employment,” the minutes said.

Bitcoin correction begins: BTC below $93k, altcoins struggle in sea of red

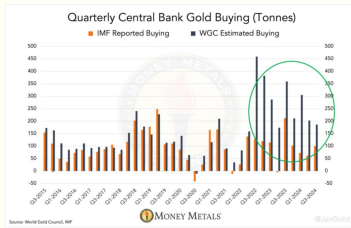

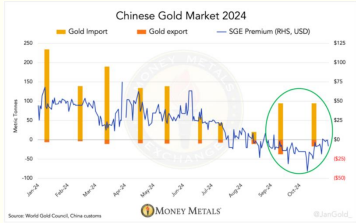

Cryptocurrencies were the odd assets out on Tuesday as stocks and gold climbed higher while Bitcoin (BTC) corrected below $92,000 and altcoins experienced a broad pullback amid the first round of post-halving bull market profit-taking. “Bitcoin has taken a notable step back from the highly anticipated $100,000 milestone, with traders locking in profits from its impressive post-election rally,” said analysts at Secure Digital Markets. “A closer look at the Coinbase premium—an indicator of institutional activity—reveals a recent trend of trading at a discount. This hints at softer demand from U.S. buyers,” they noted. “Despite spot trading volumes more than doubling compared to the past few months' average, there’s been a clear decline since BTC hit $90,000, a sign of potential bearish divergence.” Chart 1. Since mid-2022, actual central bank gold purchases have been dramatically higher than the IMF was willing to report.  Chart 2. In green, large imports while private demand on the SGE is weak, indicated by a discount relative to the gold price in London. Imports shown are destined for the PBoC, not the private sector.

Russia is leveraging gold and working with China to bypass Western sanctionsSince the West imposed unprecedented economic pressure on Russia following its full-scale invasion of Ukraine, the country’s trade practices have undergone a dramatic transformation, with Russian international trade increasingly occurring in the shadows. Access to the goods it needs now depends on constant scheming. Given that Russia operates under informal rules, this shift comes naturally. Understanding this and, particularly, the role of Russia’s new patron, China could help ensure that pressure on Russia’s war economy is applied most effectively. History shows that when the Kremlin faces a crisis such as a war or a five-year plan officials and businesses become more entrepreneurial in an effort to meet extraordinary goals. Today, the Kremlin is encouraging officials and businesses to develop new workarounds informal or illicit activities that undermine conventional trading practices. These include the sale of Russia’s most important commodity via a shadow fleet, the purchase of weapons with gold from Iran or North Korea, and a growing network of import-export entrepreneurs who channel foreign goods to Russia through third countries. Recent reports suggest that China is providing direct support to Russian defense production, signaling that China is more willing to risk Western sanctions than previously thought. In August, China tightened controls on payments with Russian companies, causing delays in bilateral trade. However, it has not prevented traders from using gold to settle payments for Russian businesses. Reporting indicates that Russian companies have been selling gold in Hong Kong and depositing the proceeds in local bank accounts to pay Chinese suppliers in lieu of using yuan or rubles directly. In this way, China is tolerating Russian workarounds a form of preemptive sanctions evasion. Chinese tolerance for Russia-related risk is not unlimited, but it is clearly supporting Russia’s workaround trade. The pressure on Beijing to assist Moscow is unlikely to subside, and gold offers a range of possibilities to extend and obfuscate their cooperation. RBI detects 300% jump in counterfeit Rs 500 notes between FY19 to FY24, Govt saysThe Reserve Bank of India recorded a 300 percent jump in counterfeit Rs 500 notes in the banking system during FY 2018-19 to FY 2023-24, according to a parliament paper shared by Union Minister of State for Finance, Pankaj Chaudhary. Counterfeit Rs 500 (Mahatma Gandhi New Series) notes detected in the banking system rose from 21,865 million pieces in 2018-19 to 85,711 million pieces in 2023-24, Chaudhary said in a written reply to a lawmaker’s query in the Lok Sabha on November 25. FY22 witnessed the sharpest annual spike in counterfeit Rs 500 notes, doubling from 39,453 million pieces in FY21 to 79,669 million pieces a 102 percent surge in a single year, the data showed. Rs 2,000 notes, which were discontinued from printing with effect from September 30, 2023 also saw a 166 percent jump in FY24, from 9,806 million counterfeit pieces in FY23 to 26,035 million pieces. China’s industrial profits fall by 10% in October as deflation worries lingerChina’s industrial profits dropped by 10% in October from a year ago, in another sign that Beijing’s stimulus measures have yet to reverse a slump in corporate earnings. That marked the third straight month of the profits decline, following a 27.1% year-on-year plunge in September, the steepest decrease since March 2020. Industrial profits are a key gauge of the financial health of factories, mines and utilities in China. In the first ten months, profits at China’s industrial firms decreased by 4.3% from a year ago, the National Bureau of Statistics said in a statement Wednesday. That was compared with a fall of 3.5% in the period through September. China is scheduled to release its official manufacturing purchasing managers’ index for November on Saturday. The official PMI is expected to come in at 50.3, according to a Reuters poll of economists, a slightly larger expansion than 50.1 in October. A reading above 50 indicates expansion in activity while one below that level suggests a contraction. | Gold volatility will continue, but price should hit $2,900/oz in 2025 on geopolitics and fiscal concerns – UBSAfter a strong rebound last week, gold is seeing further declines on waning December rate cut expectations, but the yellow metal still has strong tailwinds which should lift prices to $2,900 per ounce next year, according to commodities analysts at UBS. The analysts noted that spot gold’s Monday price decline effectively erased Friday's rally. “The pullback comes amid profit-taking after the metal's five-day winning streak and on President-elect Trump's pick of Scott Bessent for Treasury secretary,” they said. “Bessent is viewed as a ‘fiscal hawk,’ so his choice may temper federal deficit and execution concerns over the incoming president's  plans,” the analysts added. “December rate-cut expectations have continued to slide, with the CME Fedwatch tool showing money markets are pricing a 56% chance of a December rate cut, down from 62% last week.” UBS believes that continued volatility in gold prices is to be expected “amid competing signals on inflation, rates, geopolitics, and upcoming US trade policy.” “We see room for more gains in gold prices, with a target of USD 2,900/oz by end-2025,” they said. “Gold remains a useful hedge against geopolitical tensions and fiscal concerns, in our view.”

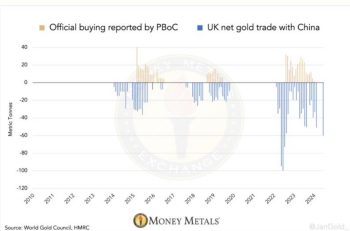

Chinese Central Bank Just Secretly Bought 60 Tonnes of Gold The People’s Bank of China (PBoC) is covertly buying very large amounts of gold, adding upward pressure to a tense gold market. An explosive cocktail of Western institutional investors and central banks in the East buying gold this year is making the gold price rise sharply. Interest rate cuts and geopolitical strain will sustain this bull market. All “non-monetary” gold (privately owned metal) in China is traded over the Shanghai Gold Exchange (SGE)1. However, since the war in Ukraine began, there has been more supply in the Chinese market than sold through the SGE; the “surplus” reflects what the PBoC buys. Gold exports from the U.K. are virtually all in the form of 400-ounce bars from the London Bullion Market. The retail market in the U.K. pales in comparison to the wholesale market that deals in “large bars” (400-ounce bars). On the SGE, very few large bars are traded—the Chinese private sector prefers 1 Kg bars. The research shows that direct exports from the U.K. to China are, in fact, purchases by the PBoC. These purchases show up in cross-border trade statistics because the PBoC buys the gold from bullion banks that take care of shipping and insurance and thus have to deal with customs. The above matches other evidence of the PBoC acquiring gold surreptitiously. By now, most gold investors are aware that the massive difference between what the World Gold Council (WGC) estimates central banks purchase in aggregate (based on field research) and what central banks in total report to the IMF is mainly attributable to the central bank of China. Chart 3. Direct gold exports from the U.K. to China (PBoC purchases) are correlated to gold additions disclosed by the Chinese central bank. Although, the PBoC usually takes up to a year to publicly report its acquisitions and keeps about 65% of it hidden.  Azerbaijani diplomat detained with 70kg of gold in TurkeyAn Azerbaijani military attaché, Colonel-Lieutenant Gahraman Shamil oghlu Mammadov, was detained near the Vadi Istanbul shopping centre in Turkey, after he was found to be carrying 70kg of gold in a taxi during a police operation targeting smuggling. The incident has sparked a major investigation involving Azerbaijani and Turkish authorities. Initial findings suggest the smuggling operation involved exploiting diplomatic immunity to bypass border inspections. Mammadov’s precise role remains unclear, with investigators probing whether he was a direct participant or unwittingly implicated. The gold’s origins and the broader network behind the smuggling operation are key focus areas of the ongoing inquiry. Mammadov, earlier identified in Turkish media as M.G.Sh., reportedly claimed the gold belonged to him and initially presented himself as an Azerbaijani diplomat. He previously served as an assistant to the military attaché at Azerbaijan’s embassy in the US and was recently appointed military attaché to Saudi Arabia.

Ghanaian Gold Trade Desk Generates $1.02B in 12 Months Ghana’s Minerals Income Investment Fund (MIIF) has generated $1.02 billion in revenue over the past 12 months through its gold trade desk. The platform was established to formalize Ghana’s small-scale mining sector, ensure gold traceability and provide a reliable market for locally produced gold. Beyond stabilizing the small-scale mining sector, the gold trade desk has directly supported Ghana’s economy by supplying $600 million to Bulk Distribution Companies for petroleum imports. This intervention has helped stabilize the cedi and mitigate foreign exchange volatility. According to Edward Nana Yaw Koranteng, CEO of MIIF, the desk consistently achieves returns of 8% on the dollar and 24% on the cedi, despite forex-related losses in September. “The gold dory from the small-scale mining companies is sold to LBMAcertified refineries, ensuring global recognition as traceable gold. This not only adds a premium to Ghana’s gold but also helps curb the exploitation that has plagued the sector,” Koranteng stated. Small-scale mining contributes up to 40% of Ghana’s total gold production but has faced challenges such as illegal mining, lack of capital and poor governance. The gold trade desk operates alongside MIIF’s Small-Scale Mining Incubation Program, which supports licensed miners with training, access to equipment and sustainable practices. MIIF is also advancing plans for a gold-backed Exchange Traded Fund to allow Ghanaians to invest directly in the country’s gold resources. New Zealand expectedly cuts benchmark rate by 50 basis points as economy strugglesNew Zealand’s central bank expectedly slashed its benchmark interest rate by 50 basis points on Wednesday, marking a third straight cut, as the country strives to boost its struggling economy. The Reserve Bank of New Zealand’s interest rate now stands at 4.25%. Economists polled by Reuters had expected the bank to cut its rate by 50 bps. In October, the RBNZ had also cut the cash rate by 50 bps, following a 25 bps cut in August. In its Wednesday statement, the central bank said economic activity in New Zealand remains subdued and output continues to be below its potential. GDP growth in New Zealand has been slowing, falling 0.2% in the June 2024 quarter, compared with the March 2024 quarter, marking the fourth quarter of contraction. It also fell 0.2% on an annual basis. “Economic activity in New Zealand remains subdued and output continues to be below its potential,” the bank said. Lower inflation has provided the country room to cut rates and fuel economic growth. |

TECHNICAL INDICATOR :

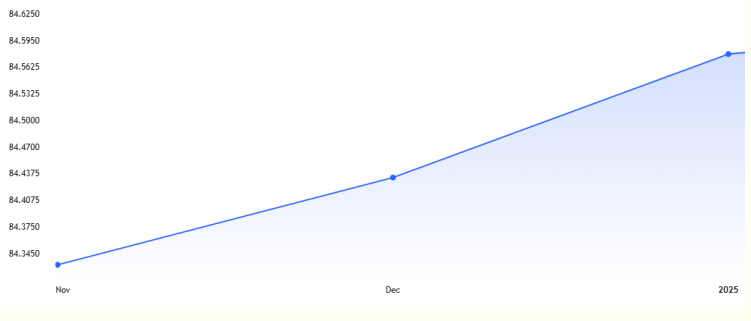

Gold Futures forward curve chart

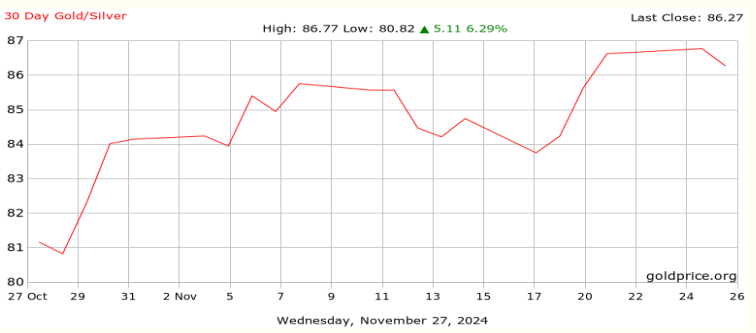

GOLD SILVER RATIO

USD INR FUTURE CONTRACT CHART

GOLD PIVOT TABLE

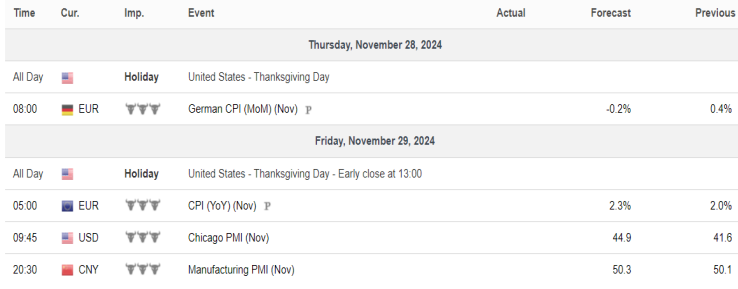

ECONOMIC CALENDAR

| |