TOP HEADLINES

Chinese Banks Raise Risk Levels on Precious Metal Products After Big Gold Price Swings

Several Chinese commercial banks have raised the risk classifications on their precious metal products, particularly for physical gold, thereby lifting the investment bar following heightened volatility in the market for the yellow metal. The precious metal products now classified as higher risk are mainly physical gold investments, Yicai found. Banks have ceased opening new accounts for these products, and existing clients can only close positions, not increase them. Gold prices are sensitive to global factors, including geopolitical tensions, interest rate policies, and inflation expectations. This year, Comex gold futures soared by more than 28 percent into early this month, then pulled back 6.5 percent, only to rebound soon thereafter. By hiking risk classifications, banks aim to protect less experienced or risk-averse retail investors from potential losses. Chinese lenders are also phasing out investment products that track commodity futures markets, while enhancing risk control measures, and tightening investor access, Yicai learned from a banking sector insider. These measures include prohibiting new account openings, limiting trading to existing customers, raising risk classifications, and setting higher minimum investment amounts. Some banks are also asking investors to redo personal risk tolerance assessments. China Construction Bank, for example, no longer allows customers whose personal risk tolerance rating is conservative and cautious to invest in certain physical gold products after it raised the risk classification. Moreover, banks may wind down trading-type investment products for precious metals, keeping only those with relatively low-risk classifications, such as physical investments, the insider added.

UOB, SGE ink MoU to deepen gold market cooperation

UOB is the only bank providing gold products in Singapore. UOB and the Shanghai Gold Exchange (SGE) have signed a memorandum of understanding to respond to the Belt and Road initiative and cooperate in ASEAN gold markets, leveraging China’s gold supply chain to connect production capacity and demand. UOB will collaborate with SGE in proprietary trading, physical delivery, and international bullion products. UOB Deputy Chairman and CEO Wee Ee Cheong highlighted the company's unique position as the sole bank providing physical gold products in Singapore, with a strong ASEAN footprint that facilitates connections between customers and gold markets across the region and in China. The partnership aims to enhance cross-border financial collaboration, providing more opportunities for gold supply chain participants.

Trump reportedly pushing for the CFTC to oversee the crypto industry

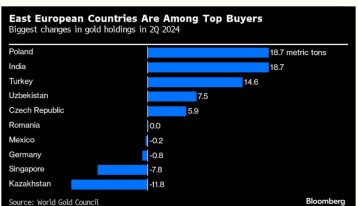

President-elect Donald Trump continues to make good on his campaign promise to reshape the face of crypto regulation in the U.S., with new reports indicating he plans to expand the power of the Commodity Futures Trading Commission (CFTC) and put the regulator in charge of overseeing the digital asset market. According to FOX Business, the move would be part of Trump’s goal of limiting the power the Securities and Exchange Commission (SEC) has over the digital asset industry, which aggressively targeted the industry under President Biden and his outgoing SEC chairman, Gary Gensler. The CFTC, which currently oversees the $20 trillion U.S. derivatives market, is widely perceived as having a lighter regulatory touch than the SEC, which would be a welcomed sight for crypto companies and investors. If Trump has his way, the CFTC’s role could soon expand to include the regulation of spot markets for digital assets deemed commodities, the report said, along with the crypto exchanges they trade on, according to sources with direct knowledge of the Trump team's thinking. | The World’s Biggest Buyers of Gold Are Now Among East European Central Banks

Iran’s gold imports at 61.5 mt in 8 month to late Nov: IRICAIran has imported some 61.5 metric tons (mt) of gold in the eight months to November 20 amid efforts to offset sanctions that restrict the country’s access to the international banking system. Figures by Iran’s customs office (IRICA) published on Wednesday showed that the value of Iran’s gold imports had reached $4.6 billion in the eight months to late November. The figures showed that Iran’s gold imports had increased by 462% and 371% in value and volume terms, respectively, year on year in April-November. Iran has been taking delivery of large gold shipments in the past two years amid a relaxation of gold import rules that are aimed at helping exporters return their proceeds to the country. A government law adopted in November 2022 allows Iranian exporters of goods and commodities to import gold to pay their hard currency liabilities to the country’s central bank. The decision was part of a previous government’s efforts to minimize the impacts of US sanctions on Iran’s economy and its access to the international banking system. IRICA statements in the past months have shown that a bulk of gold bar imports into Iran are processed via the customs office in the Imam Khomeini airport near Tehran without any information available on the origins of the shipments. Turkey has also been responsible for a part of gold exports to Iran in recent years, according to the same statements.

'A ticking time-bomb': Every American owes $108,000 in national debt and it is growing by the hour

Every American now shoulders a debt burden of $108,000 as the U.S. national debt rockets past $36 trillion. Growing by $6.3 billion daily, this financial behemoth is not only a looming economic catastrophe but a defining challenge for Donald Trump’s second term. Tesla CEO Elon Musk, handpicked by Trump to tackle this crisis, has sounded an even starker warning: “America is currently headed for bankruptcy super fast.” Musk, appointed co-head of the newly created Department of Government Efficiency (DOGE), didn’t mince words. On X, formerly Twitter, he wrote, “America is currently headed for bankruptcy super fast.” He was responding to a DOGE post highlighting a grim reality: the U.S. government spent $6.16 trillion in 2023 while generating only $4.47 trillion in revenue a shortfall fueling the country’s economic instability. In a separate post responding to the national debt figures, Musk called the situation “terrifying.” His assessment underscores the urgency of reversing decades of unchecked spending that have pushed the debt-toGDP ratio to 125%, with projections hinting it could soon hit 200%. To confront this crisis, Trump has tasked Musk and Indian-American entrepreneur Vivek Ramaswamy with dismantling bureaucratic inefficiencies and slashing wasteful expenditures. Their mission, as outlined in a Wall Street Journal op-ed, includes regulatory rollbacks, administrative reductions, and sweeping cost-cutting measures.

Falling gold prices revive physical demand in key markets A drop in gold prices this month has drawn in buyers of the metal who had been waiting for the market’s lightning rally this year to subside, industry players and analysts said. “Physical demand has picked up quite a bit since October and especially after the sharp November price drop as there has been a change in the market sentiment,” Robin Kolvenbach, co-CEO of Swiss-based refinery Argor-Heraeus, told Reuters. Forecasts by some analysts that gold could hit $3,000 supported an idea among parts of the market that prices, even above $2,700, were no longer super high. “Demand has increased quite a bit for the minted products, which are predominantly for private investors, but we also have seen an increase in production requests for physical gold from institutional investors,” Kolvenbach added. Consumers in price sensitive regions such as India had been finding it difficult to cope with gold’s rally in recent months until prices began to retreat. The current pick up in demand in India, the world’s second largest consumer after China and a major importer, will likely continue in December if prices remain around the current $2,620 level, said a Mumbai-based bullion division head of a private gold importing bank. |