TOP HEADLINES

Gold price ends the week with 5% gain as safe-haven demand drives price action The gold market has ended a three-week selloff with a vengeance, as prices look set to close Friday above $2,700 an ounce. Not only has gold surpassed last week’s losses, but the precious metal is also experiencing its best rally since October 2023. As of 1:40 p.m. ET, December gold futures were trading at $2,712 an ounce, up 1.39% for the week. Additionally, prices have risen 5.4% since the start of the week. While gold has significantly rebounded since Republican candidate Donald Trump became President-elect, some analysts suggest these gains could be more fragile than they appear. The price action has been driven primarily by renewed safe-haven demand following an escalation in the War in Ukraine. The U.S. recently gave Ukraine permission to fire U.S.- made missiles into Russia, adding a new dimension to the conflict. “Gold has very quickly recovered despite continued headwinds from a stronger dollar. Its relative performance to silver underscores why this rally has been a safe-haven rally, leading to fresh momentum buying from investors who had been waiting for a pullback,” said Ole Hansen, Head of Commodity Strategy at Saxo Bank. “Unless we see additional action in Eastern Europe, the upside from here is probably limited until we get some clarity on Trump and Fed actions.” Gold hits fresh all time highs against the euro; U.S. dollar is next The gold market has seen an impressive rally this past week, as prices managed to hold critical support above $2,550 an ounce. According to some analysts, if investors want to know where gold prices are going, they just need to look at its performance against the euro. In the spot market, gold is currently trading at €2,596.02 an ounce against the euro, up nearly 2% on the day. At the same time, gold is up nearly 7% against the euro for the week. By comparison, gold is currently trading at $2,701 an ounce against the U.S. dollar, up more than 2% on the day and over 5% for the week. Some analysts have noted that gold’s move against the euro is driven largely by growing economic weakness in Europe. The euro fell to a two-year low against the U.S. dollar on Friday after the Eurozone composite Purchasing Managers Index unexpectedly sank to a 10-month low, dropping to 48.1. The disappointing data is now prompting markets to price in aggressive monetary policy easing from the European Central Bank. However, analysts emphasize that gold’s strength should not be dismissed as merely a response to specific factors impacting this one currency. Asia Gold demand tepid in India, other Asian hubs as prices reboundPhysical gold premiums slipped in India on a pullback in demand this week as rising local prices prompted jewellers and retail buyers to stay on the sidelines, while demand for bullion in top consumer China and other major Asian hubs also remained subdued. In India, domestic prices rose to 77,220 rupees per 10 grams on Friday after falling to 73,300 rupees last week. "Jewellers were active last week following a significant price correction. However, this week, they reduced their purchases as prices increased," said, proprietor of Mumbai-based gold wholesaler. This week, Indian dealers charged a premium of up to $3 an ounce over official domestic prices – inclusive of 6% import and 3% sales levies - down from last week's premium of $16."The sudden rebound in global prices and the depreciation of the rupee to a record low drove up local prices. This confused buyers and prompted them to wait for a correction," said a Mumbai-based dealer with a private bullion importing bank.  International spot gold prices were headed for their best week in a year on Friday, supported by safe-haven demand. Despite gold futures set for the weekly gain amid the heightened tensions of the Russia-Ukraine war, trading activity in China remains soft, said, a precious metals trader. "Premiums continue to oscillate between positive and negative territory, showing no clear directional trend." Dealers in China, the world's top consumer of the metal, were charging a premium of up to $10 an ounce to a discount of $6/oz this week. In Japan, bullion was sold at par to $0.5 premium, unchanged from last week, while traders in Singapore sold it between a $1.20 and $2.20 premium. A lot of people have decided to take a backseat since gold seems to be in a bullish state at this point, said Brian Lan, managing director at GoldSilver Central. | Texas proposes gold and silver-backed currencies to compete with fiat money

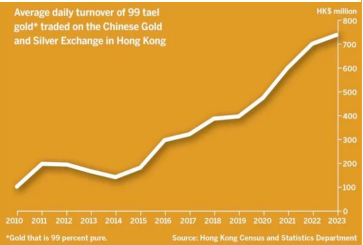

In a quest for sound money, a Texas lawmaker has filed two bills that, if passed, would create gold and silver-backed transactional currencies, backed 100% by the underlying asset, that would serve as legal tender in the state. According to a report from the Tenth Amendment Center, Texas State Representative Mark Dorazio filed House Bill 1049 and House Bill 1056 on November 12, two bills with similar language that would add provisions to different sections of the Texas legal code. “Under the proposed law, the Texas Comptroller would issue gold and silver specie (coins) through the Texas Bullion Depository and also establish gold and silver transactional currency defined as ‘the representation of gold and silver specie and bullion held in the pooled depository account,’” wrote Mike Maharrey, Communications Director at the Tenth Amendment Center. “The Depository would be required to hold enough gold and silver to back 100 percent of the issued currency.” If approved, the bills would enable “Holders of gold and silver specie and currency to use them as ‘legal tender in payment of debt,’ in the state of Texas,” he noted. “The gold and silver-backed currency would be electronically transferable to another person. Gold and silver-backed currency would be redeemable in specie or at the spot price of gold in U.S. dollars minus applicable fees.” Wall Street bereft of bears, Main Street firmly bullish as geopolitical risk breaks gold out of post-Trump slump After enduring a two-week beatdown following Donald Trump's election victory, gold prices saw a strong rebound this week, posting gains in every trading session and gaining nearly $150 by Friday Kitco News Gold Survey, and the bears have all returned to their caves as no one on Wall Street was willing to bet against gold in the near term. Fully 16 experts, or 89%, expected to see gold prices rise during the week ahead, while the remaining two analysts, representing 11% of the total, expected to see price consolidation for the precious metal. Meanwhile, 189 votes were cast in Kitco’s online poll, with Main Street sentiment rebounding back into bullish territory along with the price action. 125 retail traders, or 66%, looked for gold prices to rise next week, while another 36, or 19%, expected the yellow metal to trade lower. The remaining 28 investors, representing 15% of the total, expected gold to trend sideways in the near term.  Hong Kong eyes growth in gold trading amid global shiftsHong Kong is positioning itself as a global gold trading hub to diversify its financial landscape and capitalize on the precious metal’s enduring appeal as a safe-haven investment. This move, announced by Chief Executive John Lee Ka-chiu, comes at a time of heightened geopolitical tensions and growing global demand for gold as a reserve asset. As China Daily highlights, gold has long served as “a key safe-haven investment and an important anchor in the precious metals category.” Beyond its value as jewelry and coins, it plays a critical role in reserve assets and financial trading, enabling investors to manage risk through spot and futures contracts. Hong Kong’s Legislative Council member Tan Yueheng sees the initiative as a strategic opportunity to strengthen the city’s position as a comprehensive financial center. Tan notes that while Hong Kong has robust stock, bond, and currency markets, its commodity trading sector remains underdeveloped. Expanding the city’s role in gold trading could attract investors and position Hong Kong as a critical node in the global gold market. A cornerstone of the plan involves expanding the Hong Kong International Airport (HKIA) Precious Metals Depository. The facility’s current capacity of 150 metric tons will be increased to 200 tons initially, with a long-term goal of reaching 1,000 tons. This expansion is expected to enhance services like insurance, testing, certification, and logistics, creating a comprehensive ecosystem for gold trading and storage  |

TECHNICAL INDICATOR : USD – INR PIVOT TABLE

GOLD PIVOT TABLE

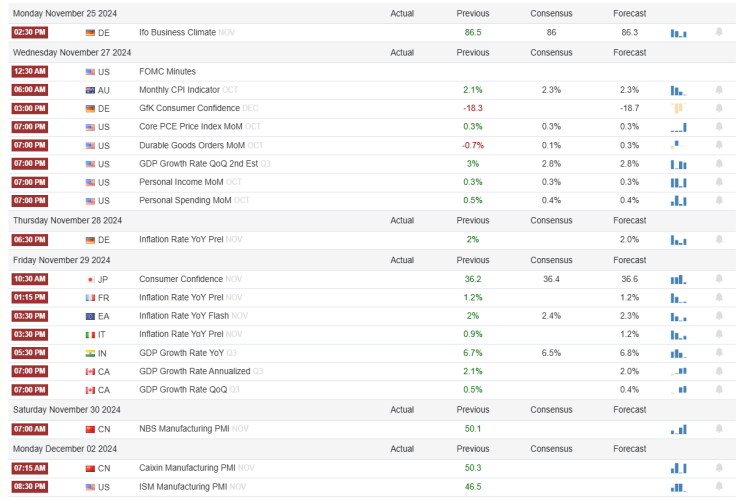

ECONOMIC CALENDAR | |