TOP HEADLINES

Gold climbs for fourth day with elevated safe-haven demand Gold prices are higher and hit a two-week high in early U.S. trading Thursday. Silver prices are near steady. Some more safe-haven demand is featured in the yellow metal. Technical buying has also increased this week as the near-term chart posture continues to improve. Technically, December gold bulls and bears are back on a level overall near-term technical playing field. A price downtrend on the daily bar chart has been negated. Bulls’ next upside price objective is to produce a close above solid resistance at $2,700.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,600.00. First resistance is seen at the overnight high of $2,676.20 and then at $2,700.00. First support is seen at the overnight low of $2,651.60 and then at Wednesday’s low of $2,621.90 Rupee breaches 84.50 mark as foreign funds continue to sell stocks  The rupee, under pressure for almost two months now, has plumbed new lows breaching the 84.50 mark on Thursday as foreign funds continued to dump domestic equities on one hand and the dollar kept pace with its northward-ho. The rupee closed the trade at 84.501, on a day when the equity market was whacked after Adani group stocks fell nine pins after a US court criminally indicted chairman Gautam Adani and six other key officials for alleged bribery and other legal breaches in raising funds and securing solar power project contracts. The rupee had closed at 84.4137 close on the previous trade on Tuesday. The rupee was dragged by selling in equities by foreign portfolio investors and a strong dollar index, traders said. The rupee has been under pressure since last month on higher dollar demand and FPI selling along with higher interest rates in the US on the treasury notes are also prompting FPIs to move their money back home in search of better returns, which is also putting pressure on the local currency. Pakistan Gold imports increase by 19.82 % to $10.6 mln in 4 months The imports of gold increased by 19.82 percent during the first four months of the current fiscal year as compared to the corresponding period of last year, Pakistan Bureau of Statistics (PBS) reported. The gold imports during the July-October (2024-25) were recorded at $10.644 million as compared to the imports of $8.883 million during July-October (2022-23), according to PBS data. In terms of quantity, Pakistan imported 148 kilograms of gold during the period under  review as compared to the imports of 138 kilograms last year, showing increase of 6.94 percent. On yearon-year basis, the gold imports increased by 32.32 percent in October as compared to the same month of last year. The gold imports during October 2024 were recorded at $2.096 million compared to imports of $1.584 million in October 2023. In terms of quantity, the gold imports declined by 9.29 percent to 24 kilograms in October 2024 as compared to the imports of 26 kilogram during October 2023. On month-on-month basis, the gold imports during October 2024 decreased by 54.63 percent when compared to the imports of $4.610 million in September 2024. In terms of quantity, the gold imports declined by 64.80 percent when compared to the imports of 67 kilogram during September 2024. | Gold is giving back $250 election premium, $300 China premium at risk from stimulus – Societe Generale The analysts said that $250 per ounce worth of the gold price rally that was seen ahead of the U.S. election was not justified by the usual drivers, and that additional premium is now evaporating. “With the US election behind us, gold is gradually reconnecting with the strong appreciation of the US dollar and the increase in real interest rates observed in October and November started to exert downward pressure on prices,” they said. “Long speculative future positions started to be liquidated from overextended levels and we expect this to continue in the short term,” the analysts wrote. “This should lead to the election premium partially fading and should see gold price weakness in the short term. The long-term drivers, namely large central bank gold purchases, growing US public debt, increased geopolitical risks, and global uncertainties stemming from a polarising world, all point to continued support for gold.” Gold, along with U.S. stocks, have actually been the key components for the strong returns of the Société Générale Multi-Asset Portfolio (SGMAP) this year “A significant part of the $300/oz premium above gold’s theoretical value build in March-April was driven by Chinese investors turning to gold due to limited local investment options,” the analysts wrote. “Recent stimulus measures from Beijing, and the additional dry powder kept in reserve to adapt to Trump’s policies on China, could improve domestic investment opportunities. In such a situation, a shift of Chinese investment away from gold and back into local equities or real estate could result in a $300 correction in gold prices.” China finds $83 billion worth of gold reserves in Hunan China has found gold reserves worth 600 billion yuan ($82.9 billion) in central Hunan province, state outlet Xinhua news said on Thursday. China is the world's largest gold producer, accounting for around 10% of global output in 2023, data from the World Gold Council showed. It consumed 741.732 metric tons of gold in the first three quarters of this year while output was 268.068 tons, meaning it has to rely on imports to meet domestic demand. Hunan Academy of Geology found more than 40 gold ore veins at a depth of more than 2,000 meters in Pingjiang county, with a total of 300.2 tons of gold resources discovered in the core exploration area and a highest grade of 138 grams per metric ton, Xinhua said. The group forecast that there were more than 1,000 tons of gold reserves at a depth of over 3,000 meters, according to Xinhua. Gold reserves generally refer to the economically extractable part of a resource. Gold prices have rallied this year on the back of rising geopolitical tensions globally. Bitcoin hits fresh record, races toward $100,000 as rally continuesBitcoin breached the $98,000 level for the first time Thursday as investors continued pricing in a second Donald Trump presidency. The price of the flagship cryptocurrency was last higher by more than 3% at $97,541.61, according to Coin Metrics. Earlier, it rose as high as $98,367.00. Bhutan’s Bitcoin Binge: Country’s crypto holdings top $1.1 billion, valued at over a third of its GDPThe Kingdom of Bhutan has amassed a crypto fortune that is now valued at $1.1 billion, more than a third of the country’s total gross domestic product (GDP), up from just about $3,500 in March 2021. This surge in the value of the Himalayan nation’s crypto holdings has been driven not only by the rally in the price of Bitcoin, but also by a concerted and targeted policy followed by the government’s investment arm to significantly grow the country’s crypto asset holdings |

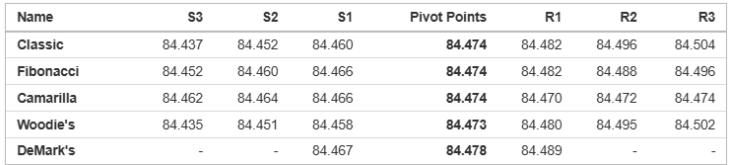

TECHNICAL INDICATOR : USD – INR PIVOT TABLE

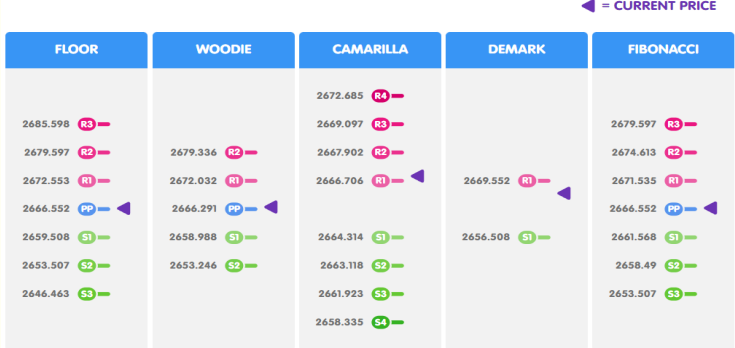

GOLD PIVOT TABLE

ECONOMIC CALENDAR | |