TOP HEADLINES

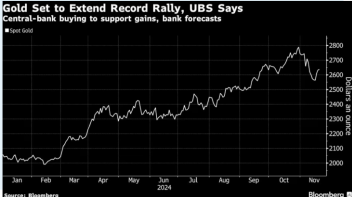

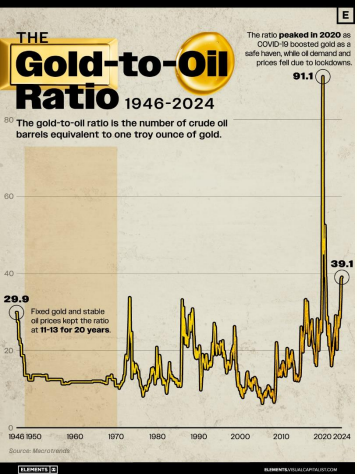

UBS Joins Goldman in Forecasting Gold’s Rally Isn’t Over Gold will rally to $2,900 an ounce by the end of next year, according to UBS Group AG, echoing a call from Goldman Sachs Group Inc. for further gains as central banks expand their holdings. There’s likely  to be a period of consolidation due to the stronger dollar and concerns over the potential for more US fiscal stimulus to lead to higher rates before the precious metal starts climbing again, UBS analysts including Levi Spry and Lachlan Shaw said in a note. Bullion would rise a little further, to $2,950 an ounce, by the end of 2026, they said. “The US Red Sweep, strong diversification buying interest and elevated global uncertainty to continue to support prices,” the analysts said. Gains “should be driven by continued strategic gold allocations and official-sector purchases in a backdrop of high macro volatility and persistent geopolitical risks,” they said. Gold has been one of the strongest performing commodities of 2024, setting successive records before a pullback following the US presidential election as the dollar spiked. The year-to-date advance has been supported by central-bank accumulation, the Federal Reserve’s pivot to monetary easing, and geopolitical tensions in Europe and the Middle East. Spot gold traded near $2,624 an ounce, and has rallied 28% this year. Goldman Sachs forecast this week that the precious metal would climb to $3,000 an ounce by the end of next year. That bullish view hinged on higher demand from central banks, plus flows to exchange-traded funds as the Fed cuts rates. UBS also flagged more buying from monetary authorities. “The official sector, which tends to buy physical gold bars, is likely to continue adding to reserves, for diversification purposes and amid geopolitical tensions and sanctions risks,” it said. “Many central banks’ gold reserves remain small as a percentage of total assets.” Gold traders in Kuwait divided over ban on using cash in sale of metalA number of gold, legal and consumer protection experts have confirmed that the use of electronic payment methods in sale and purchase transactions in the local market played a major role in reducing money laundering operations in the country. They affirmed that such trends are consistent with the measures taken by the State to ensure transparency in financial and commercial transactions, especially after the Financial Action Task Force (FATF) threatened to put Kuwait on the gray list. In a special investigation conducted by the newspaper, these experts stated that the steps taken are in line with measures or decisions related to preventing the sale of gold in cash; as it must be in large quantities or by gold suppliers. However, some think there is a need to leave a margin for cash sales like the decision regarding pharmacies; where cash sales of up to KD10 are allowed for medicines, while others think that selling gold through electronic payment only would lead to losses for gold shop traders, as buying and selling operations sometimes overlap. Visualizing the Gold-to-Oil Ratio (1946-2024) Gold and oil two of the most influential commodities on the planet have a fascinating relationship that has evolved over decades, captured in the gold-to-oil ratio. The gold-to-oil ratio represents the number of barrels of crude oil equivalent in price to one troy ounce of gold. It is viewed as an indicator of the health of the global economy, indicating when gold or oil prices are significantly out of balance with each other. This graphic shows the gold-to-oil ratio since 1946, using data compiled by Macrotrends. A high ratio indicates that gold is relatively expensive compared to WTI crude oil, and vice versa. This can indicate periods of outsized demand for energy in the form of crude oil, or periods of monetary uncertainty when there is higher demand for gold. | Ads for five gold dealers banned for failing to make lack of regulation clear – UK NEWSAds for Bullion Club, Gold Bank, Harrington & Byrne, Solomon Global and The Pure Gold Company were all banned. The advertising watchdog has banned ads for five gold dealers for failing to make clear that the investments are unregulated and their value could vary. The Advertising Standards Authority (ASA) investigated the ads for Bullion Club, Gold Bank, Harrington & Byrne, Solomon Global and The Pure Gold Company as part of wider work on unregulated investments. The Google ad for Bullion Club, seen in June, said “gold has historically held its value over time, making it a good hedge against inflation,” while a press ad for Gold Bank in May read: “Could this be the best investment you ever made?”. The ASA investigated whether ads for all five dealers were misleading because they failed to illustrate the risks of the investments. We concluded that the ads were misleading ASA. The Bullion Club said they understood the importance of informing potential investors that investments could vary, and said they had amended their information to make it more prominent Swiss Gold Industry to Focus More on Sustainability, Transparency in Future, Industry Group’s Head Says Switzerland’s role in the gold industry will focus increasingly on sustainability and transparency in the future, according to the president of the Swiss Association of Manufacturers and Traders in Precious Metals. Despite higher costs and a smaller market share, Switzerland aims to stay competitive by ensuring its gold is ethically sourced, Christoph Wild noted in a recent interview with Yicai. This presents an opportunity for the country to showcase that responsible, ethical practices are possible in an industry whose reputation is sullied at the moment, he said. As one of the world's 12 major gold refining centers, Switzerland plays a key role in refining the yellow metal and also has a unique authority in setting global standards. The ASFCMP, which Wild heads, represents its major precious metal refiners and traders, and is the country’s most influential group in the field. China-Africa Precious Metals Opens New Gold Processing Plant, Creating 4,000 Jobs in North West The China-African Precious Metals Company has officially opened its newly refurbished gold processing plant in Orkney, within the City of Matlosana Local Municipality, as part of a R2 billion investment in the region. The refurbishment of the plant, which cost over R200 million, is expected to create nearly 4,000 job opportunities in the area, providing a major boost to the local economy. The official launch of the gold processing plant was attended by prominent figures, including Minister of Mineral and Petroleum Resources Gwede Mantashe, Premier of the North West, Kagiso Lazarus Mokgosi, and the Executive Mayor of City of Matlosana Local Municipality, Councilor Fikile Mahlope. Former Acting Premier, Nono Maloyi, was also present for the event. Higher supplies to the UK lift Swiss October gold exportsGold exports from Switzerland rose in October compared to September due to higher supplies to Britain, but were down from a year ago as high gold prices kept deliveries to China and Hong Kong subdued, Swiss customs data showed on Tuesday. Supplies from Switzerland, the world’s biggest bullion refining and transit hub, to Britain in October reached the highest level since June 2021, according to the data. London is the world’s largest centre for over-the-counter (OTC) trading of gold. This year’s 27% gold price rally, which took spot prices to a record high of $2,790.15 per troy ounce on Oct. 31, has been affecting physical demand in China, the world’s top consumer of the metal. However, gold exports from Switzerland to India, the world’s second-largest gold consumer and a major importer, rose in October from September amid festival purchases. |

TECHNICAL INDICATOR : USD – INR PIVOT TABLE

GOLD PIVOT TABLE

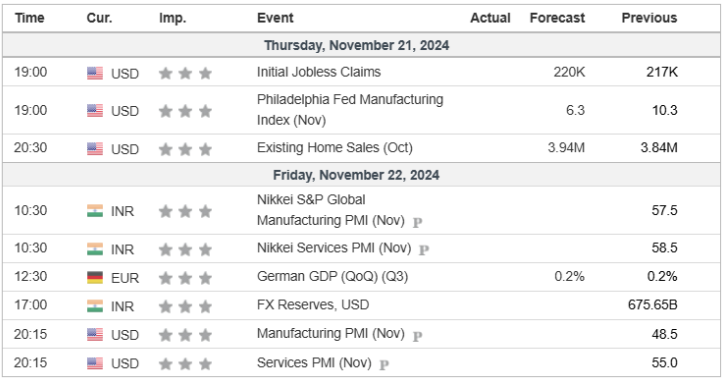

ECONOMIC CALENDAR

| |