TOP HEADLINES

Gold and silver rally on rising US-Russia tensions • Precious metals enjoyed a strong run-up ahead of the US elections but turned sharply lower after a simultaneous surge in the USD and yields forced prices through key technical support levels. • A correction that has now ended as heightened US–Russia tensions drive fresh demand for safe havens such as precious metals, as well as the Japanese yen, Swiss francs, and short-duration government bonds. • The US debt situation will likely continue to deteriorate as the Trump administration increases unfunded spending towards tax cuts, infrastructure, and defence. • It is worth noting that a recent drop in speculative positions in the futures market has almost entirely been driven by long liquidation, not fresh short selling. Gold and silver prices continue to recover, with gains in both supported until yesterday by a fading dollar rally and, now, by worsening US–Russia relations after President Biden approved Ukraine's use of long-range missiles against Russia. This culminated this morning when the Kremlin stated, “Any aggression against Russia by a non-nuclear state with participation of a nuclear state will be considered a joint attack.” Shortly after, one newswire reported that Ukraine had made its first ATACMS strike inside Russia, resulting in fresh demand for safe havens such as precious metals, as well as the yen, Swiss francs, and short-duration government bonds. Emirates Gold acquired by Bright East Holding 1; rejoins UAE’s Good Delivery ListEmirates Gold, a leader in the UAE’s gold and precious metals refining and minting industry, has been fully acquired by Bright East Holding 1, a holding company registered with the Abu Dhabi Global Market (ADGM). The acquisition comes alongside Emirates Gold’s reinstatement on the UAE’s prestigious Good Delivery List, marking a transformative chapter as the company enters a new era focused on innovation, technological advancement, and global expansion under the leadership of newly appointed CEO Abhijit Shah, who was unanimously chosen by the board of directors. With a renewed strategic direction, Emirates Gold is set to enhance operational stability, reconnect with legacy clients, and drive revenue growth, all while expanding its regional and global presence. Key priorities include enhancing smelting and refining capacities, forging strategic industry partnerships and upholding stringent compliance policies and procedures, ensuring the highest industry standards are met across all operations. Hungary’s gold reserve tops that of Romania for the first time in history after 14.5 ton acquisitionFor the first time in modern history, Hungary holds more gold reserves than Romania after the National Bank of Hungary purchased 14.5 tons of gold at the end of September this year. The price of gold gold has increased by 25% this year alone and reached an all-time high of USD 2,790 in October, but the trend has reversed since the election of Donald Trump, which brought new highs on the stock and crypto markets. Many central banks, including those of Poland, Turkey, Serbia, China, India, and Singapore, increased their gold reserves over the past three years. According to data from the National Bank of Romania (NBR), the official gold holdings of the country amount to 103.6 tons. Of this, about 61 tons (or 59%) are held in the vaults of the Bank of England. With this quantity, Romania ranks 39th globally in terms of international gold reserves and sixth in the Eastern European region. Gold prices near session highs as U.S. housing starts fall 3.1% in October Gold prices are trading near session highs on Tuesday morning after the latest U.S. housing construction data declined more than expected last month. Housing starts declined by 3.1% in October to a seasonally adjusted annual rate of 1.311 million units, the Commerce Department announced on Tuesday. The data came in worse than expected as economists looked for a smaller decrease to 1.330 million units. September saw 1.354 million units. For the year, housing construction is down 4.0% compared to activity in October 2023. | LBMA Adds India’s Choksi Heraeus to Silver Good Delivery List Choksi Heraeus Pvt. Ltd. (CHPL), a leading silver refinery based in Udaipur, Rajasthan, India, has been added to the London Bullion Market Association (LBMA) Good Delivery List for silver, effective from 14th November. To secure this coveted status, CHPL underwent rigorous testing procedures conducted by independent referees. The refinery’s silver bars were meticulously examined and assayed, while its in-house assaying capabilities were rigorously assessed. CHPL successfully met LBMA’s stringent criteria for ownership, history, production capacity, and financial standing. Established in 1988, CHPL has a rich history in silver refining. In 1994, the company formed a joint venture with Heraeus, a global leader in precious metals, further enhancing its technological capabilities and international standing. Today, CHPL operates an integrated facility equipped with advanced electro and chemical refining processes, enabling it to handle substantial volumes of silver refining. The LBMA Good Delivery List is a globally recognized benchmark for the quality and purity of precious metals. The list now includes 65 gold and 81 silver refiners. UAE overtakes U.K., becomes second-largest gold hub with over $129 billion in trade

The UAE is becoming one of the major gold trade hubs around the world with significant growth in trade value. In 2023, the UAE surpassed the United Kingdom, becoming the second-largest gold trade hub worldwide, with over $129 billion in total trade, a rise of 36 percent over 2022. The latest report from the Dubai Multi Commodities Center reveals that major shifts in the global gold trade will likely propel an ‘Asian century’ for gold, with a particular focus on the development of a new gold economic corridor among BRICS nations, including the UAE, that can provide an alternative to traditional gold trade centers. “In recent years, we have witnessed historic shifts in the precious metals market, driven by Western sanctions that have forced record buying of gold by central banks and a rethink by many countries when it comes to their reliance on the U.S. dollar. We are seeing a new gold corridor form across Asia, with Dubai at its center – exemplified by the UAE’s rise to become the world’s second-largest gold trading hub last year,” stated Ahmed Bin Sulayem, executive chairman and CEO of DMCC. Russian war machine funded by illicit gold trading, WGC report statesRussian State-funded private military company (PMC) Wagner Group is one of the greatest beneficiaries of illicit gold trading, a new report published by the World Gold Council (WGC) shows.  According to the report, penned by former UK Deputy Prime Minister Dominic Raab, estimates suggest the PMC earned more than $2.5-billion from illicit gold mining since the invasion of Ukraine alone, which has been funnelled back into the Russian war machine. Although artisanal and small-scale gold mining (ASGM) provides income for millions of people in more than 80 countries, some estimates indicate that 80% of ASGM takes place in the shadow economy. The ASGM industry is responsible for an estimated 20% of global yearly gold supply and about 80% of overall gold mining employment. WORLD CENTRAL BANKS RATE |

TECHNICAL INDICATOR : USD – INR PIVOT TABLE

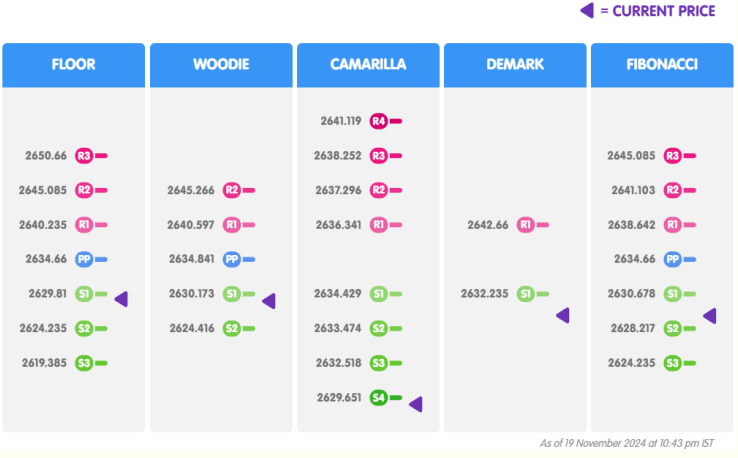

GOLD PIVOT TABLE

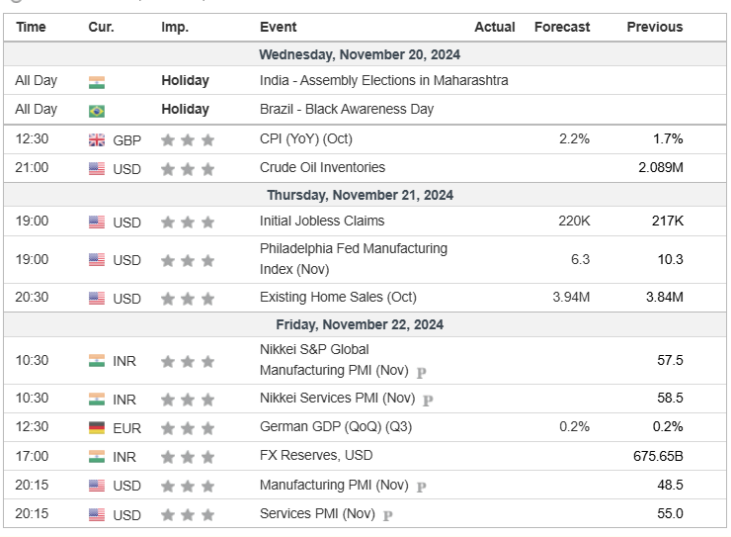

ECONOMIC CALENDAR | |